WELCOME

Senior Living Options that Support Aging Well

Choose a home that fits your lifestyle and is designed with the future in mind. In one of our continuing care retirement communities you can live more and worry less.

Who are you searching for?

Myself

Explore Options

A Loved One

Explore Options

A complete continuum of services

No matter where you find yourself in life, you’ll have just what you need, when you need it.

Make a Decision that Only Gets Better With Time

Take advantage of more time for the things you enjoy with maintenance free living.

Feel secure in your financial future with a Foundation that supports your care.

Have peace of mind knowing support is in place in case of an unexpected event.

Unburden family by making a long-term plan that promotes living and aging well.

When is the Right Time to Choose Community Living?

Whether you’ve been considering a move like this for years or have just begun your search, you likely have plenty of questions. While everyone’s circumstances are different, most individuals have the same goal in mind – to live and age well, with choice, comfort and opportunities you can take advantage of. Ask yourself:

- Is my current home ideal for me as I get older?

- Do I know what the future holds and the care I may need one day?

- Who will I need to rely on in the future if I need support or services to remain independent?

- Do I want more time to explore my interests, participate in social opportunities or improve my health and wellness?

- Do I know what options are available today and which make the most sense for me?

Get Your Questions Answered

Discover lifestyle options for your needs

Lifestyle Options

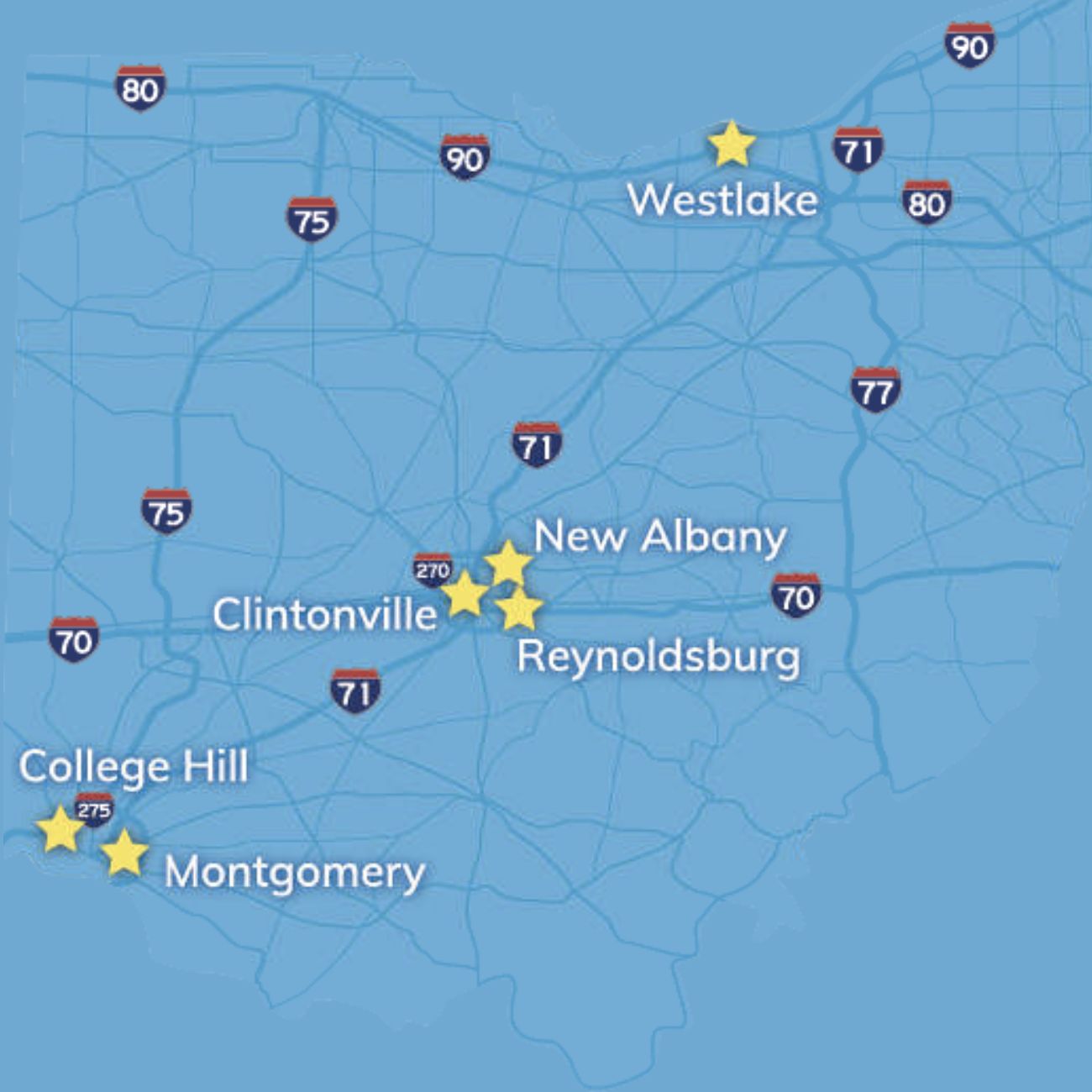

Locate a community in your desired area

Explore Communities

Take a tour to see what our communities offer

Schedule a TourAmenities

Take advantage of all the LEC communities have to offer: entertainment spaces, fitness centers, libraries, game rooms, spas, programs and outings, and more. Enjoy what you want — as little or as much of it.

Events and Programs

Fill your days with unlimited opportunities to enjoy doing the things you love most.

Culinary Creations

With a variety of dining options at each of our communities, you’re sure to always have the meal you desire.

Fitness and Wellness

Put your healthiest foot forward with on-campus fitness and wellness centers offered at most of our campuses.

Social Opportunities

Meet your neighbors and make friends with a variety of ways to mix and mingle.

Entertainment

Catch a movie in the theater or attend a live performance – entertainment is right at your fingertips.

Through the generosity of others, the Foundations at Life Enriching Communities support the growing needs of residents and associates, allowing people to live their best life every day. Gifts make an immediate impact- offering vital resources and diverse opportunities for those who live and work in our communities.

Life Enriching Communities Featured in Movers & Makers March Issue

Jim Bowersox, chief operating officer for LEC, shares his insights on how seniors and technology intersect in our region. Click below to read the full article!